Part 3: Payment Integrity KPIs and Reporting Strategies

Written by Monique Pierce, Head of Payment Solutions at Cohere Health

In this blog, we’ll review key performance indicators (KPIs) by PI program and a reporting strategy that has proven very effective. Whether your PI program is centralized or decentralized, evolving or mature, this content is meant to offer guidance and spark discussion as we embark on the standardization journey together.

Payment integrity metrics

KPIs require a solid foundation of metrics, and it is essential to build specific metrics and reports/dashboards based on type and purpose. Here are recommendations for how to categorize PI metrics:

- Operational metrics (Inventory, Production, Quality)

- Financial metrics (Cost, Savings)

- Performance metrics (Staff, Program)

Operational metrics

Operation metrics help you manage the work. Inventory, production, and quality headers include a distinct set of metrics with a specific purpose.

- Inventory metrics include volume, status, and aging. Trending these values overall and by status and status reason over time helps ensure adherence to regulatory requirements/policy and provides insight for staffing and forecast projections. However, these are point-in-time metrics, rendering them an inappropriate source for outcome reporting.

- Production metrics include counts, turnaround time (TAT), dollars, and percentages. They capture counts, TAT, percentage results, and dollars for a specific period (daily, weekly, monthly, etc.). These outcome or result metrics can be applied to each key process within a program (Selection, Records, Review, Letters, Dispute, Recovery (avoidance for prepay).

Counting each key action, calculating the TAT, and summing savings dollars provide necessary data for projections and identifying areas of opportunity. Production metrics are foundational for measuring staff, program, and process performance improvement.

- Quality metrics include counts, status, and percentages. Knowing how many reviews or disputes have been completed is not enough–one must also understand the percentage of work QA’d and the error rate. These metrics often have regulatory or SLA requirements. They are used for staff evaluation and provide insight into areas of opportunity for program performance improvement.

Financial metrics

Financial metrics describe the cost and benefit of the work completed due to payment integrity activity. A finance team will typically ask PI leaders to track staff and vendor costs and final savings dollars associated with the work, while they track other fixed-cost expenses.

- Savings metrics include counts, dollars, and dollars/ID reporting. Most programs prioritize these metrics.

Dollars are represented in three categories based on where in the life cycle the savings occur:

- Via post-pay programs (recovery)

- Via prepay programs (avoidance)

- Before the claim is received (prevention)

- Cost metrics include administrative, staff, BPO, vendor contingency, and per audit. They track the direct cost of the PI activity and are used to identify opportunities and calculate ROI.

Performance metrics

KPIs allow leaders to measure or evaluate the performance of a process or program. They are typically a more complex metric, requiring a calculation or comparison of two or more metrics over time to normalize the data.

- Staff KPIs include productivity (action/time, audits/ hour), quality% (errors/reviews), and TAT to monitor effective inventory management.

- Program KPIs include the same productivity, quality, and TAT at the program level.

Some claim audit KPI examples include:

- Average # audits/hour

- % Accurate review

- % Medical records received

- % Audits with an error/ overpayment identified (finding or hit rate)

- % Disputes and % disputes overturned

- Average # of days to recover

Performance metrics also incorporate financial metrics to produce total savings, savings/audit, and ROI (comparison of savings and costs), and member and claim metrics, such as total eligible members, total claim count, and total medical expense, to create savings as a % of medical expense and savings PMPM.

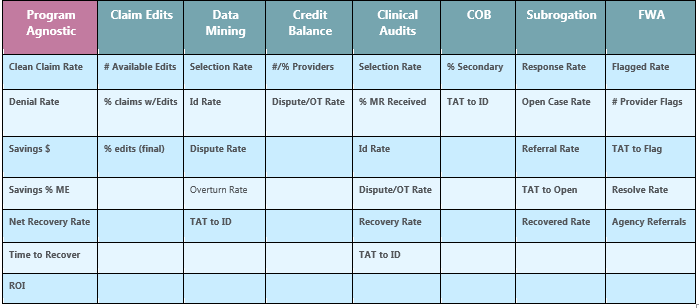

While many KPIs are program agnostic, some programs or solutions have unique KPIs to measure and monitor unique processes. Below are suggested KPIs for seven high-level solutions/program types.

PI reporting strategy

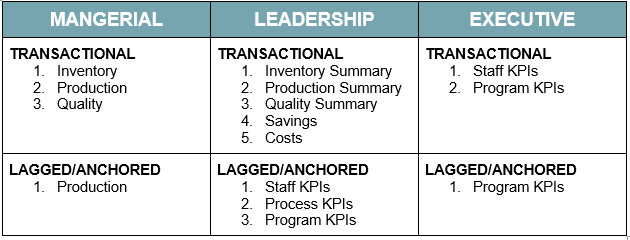

Whether you are using spreadsheets or reports/dashboards built in a business intelligence (BI) tool, an essential step in creating a reporting strategy is to differentiate the output by purpose and audience. Your executive team does not need the same data or level of detail as your leaders, who may not need the same ability to drill down as your supervisors/managers. The chart below describes three reporting levels–managerial, leadership, and executive–and two views (transactional and lagged). Each provides a different perspective on performance.

The key data needed to support PI reporting include:

- Transactional dates: DOS month, paid month, medical record received month, ID month, savings avoided or recovered month

- Financial amounts: Paid amount, prepay avoided amount, postpaid savings, total savings

- Audit/case identification criteria: Program name, claim #

- Optional trending criteria: Member LOB/ product/market and provider number, specialty, status

With one set of data, it is possible to create three levels of reporting and present the data either by transaction month (paid or savings month) or, for more insight into performance, by anchored or lagged month (DOS, selection, ID month) to measure change in performance. Note that the types of reporting align with the operation, financial, and performance metrics from earlier.

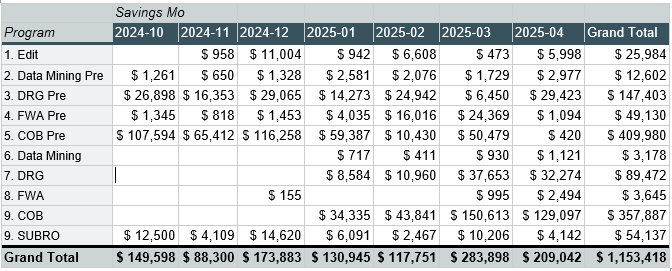

Transactional reports detail individual events or activities. The metrics displayed are expected to remain static as they represent data for a defined date range.

For example, the count of reviews completed in January or the dollar amount saved in February will be the same if you view the report in March, April, or December.

Transaction report sample

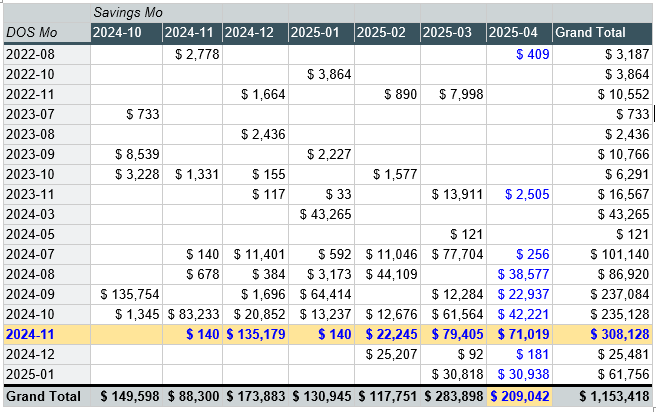

Lagged reports track the exact details for individual events or activities; however, the same data is displayed to demonstrate relative performance.

For example, we can compare savings from month to DOS month to calculate PMPM. The count of reviews and savings completed is reported using both DOS month and savings month—one as row and one as column; hence, the term lagged.

Lagged report sample

In our fictional data above, as of April 2025, the savings for claims with a DOS in November 2024 are $308,128. There were recorded savings across six months; this data is not static. Each time the data is refreshed, additional results may be added. As of April 2025, savings of $209,042 would be reported. This view demonstrates savings for claims with seven different DOS months.

Summary

In this edition of our PI 101 series, we examined performance metrics and reporting strategies to meet the needs of various stakeholders. From suggested KPIs by program to a practical lag table that calculates Savings PMPM, this blog lays the groundwork for effective benchmarking and measurable impact.

Read more about our industry standardization initiative and proposed guidance from key thought leaders in upcoming posts.